jacksonville fl county sales tax

Property assessments performed by the Assessor are. Alachua County FL Sales Tax Rate.

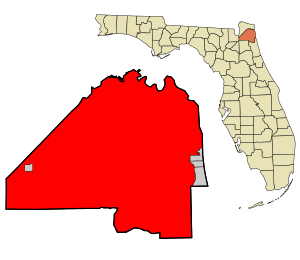

Jacksonville Florida Facts For Kids

The rules behind this surtax cap have created a lot of confusion.

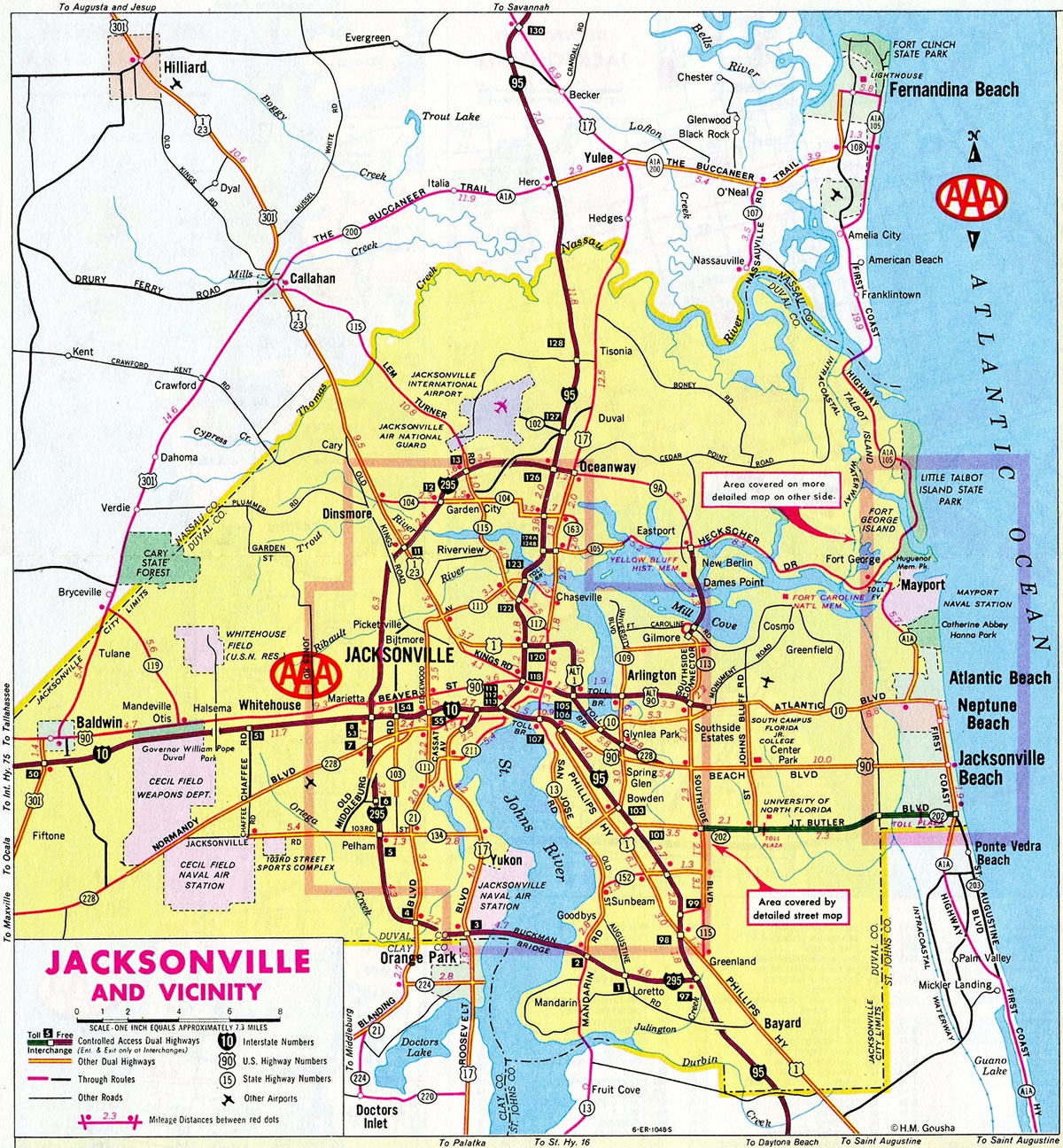

. Ed Ball Permitting Branch. Tax Rates By City in Duval County Florida. Florida has a 6 sales tax and Duval County collects an additional 15 so the minimum sales tax rate in Duval County is 75 not including any city or special district taxes.

Many answers regarding property taxes can be found in the FAQ section of this website. Jacksonville s consolidated city-county government structure eliminates duplicate services and encourages communication between government entities which lowers taxes and increases the efficiency of government. Duval County Tax Collector 231 E.

The Florida state sales tax rate is currently. Lowest sales tax 6 Highest sales tax 75 Florida Sales Tax. Directions Jacksonville FL 32225.

This document provides a history of the locally-imposed county tax rates. The 75 sales tax rate in Jacksonville consists of 6 Florida state sales tax and 15 Duval County sales tax. There are a total of 367 local tax jurisdictions across the state.

You can print a 75 sales tax table here. Combined with the state sales tax the highest sales tax rate in Florida is 75 in the cities of. This includes the rates on the state county city and special levels.

Every 2018 combined rates mentioned above are the results of Florida state rate 6 the county rate 05 to 1. Forsyth Street Jacksonville FL 32202 904 255-5700 Email. Jacksonville collects the maximum legal local sales tax.

For more information regarding the tax sale process tax certificates or tax deeds please contact the Tax Department at 904 255-5700 option 4 or correspondence may be mailed to. Automating sales tax compliance can help. Baker County FL Sales Tax Rate.

The minimum combined 2022 sales tax rate for Jacksonville Florida is. To review the rules in Florida visit our state-by-state guide. This article is designed to help clear up the confusion.

Tax Sale Certificates and Tax Deeds. What is the sales tax rate in Jacksonville Florida. The sales tax rate does not vary.

The Duval County Sales Tax is collected by the merchant on all qualifying sales made within Duval County. 4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. The Jackson County sales tax rate is.

Florida has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 15. Check with your local tax collectors office to see what they require. There is no applicable city tax or special tax.

The Jacksonville Florida general sales tax rate is 6. This table shows the total sales tax rates for all cities and towns in Jackson County. Floridas general state sales tax rate is 6 with the following exceptions.

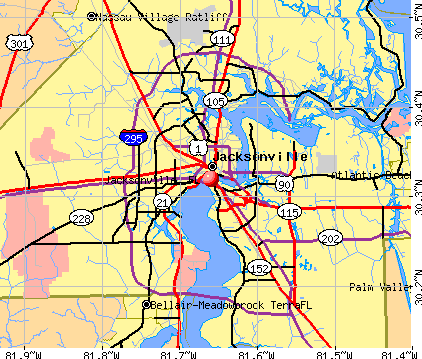

Bradford County FL Sales Tax Rate. 4729 Us Highway 17 Ste 201. Jacksonville Beach is located within Duval County Florida.

734 rows 2022 List of Florida Local Sales Tax Rates. The Duval County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Duval County local sales taxesThe local sales tax consists of a 100 county sales tax. 2020 rates included for use while preparing your income tax deduction.

Within Jacksonville Beach there are around 2 zip codes with the most populous zip code being 32250. Before we issue a Local Business Tax Receipt a business must meet all required conditions. For tax rates in other cities see Florida sales taxes by city and county.

Groceries are exempt from the Duval County and Florida state sales taxes. History of Florida Sales and Use Tax 3 - November 1 1949 to March 31 1968 4 - April 1 1968 to April 30 1982 5 - May 1 1982 to January 31 1988. Brevard County is located in the east central portion of the US.

Depending on the zipcode the sales tax rate of Jacksonville may vary from 6 to 7. Tax Department 231 E Forsyth St Room 130 Jacksonville FL 32202. Find and pay your taxes online.

The Jacksonville sales tax rate is. Average Sales Tax With Local. The County sales tax rate is.

The average cumulative sales tax rate in Jacksonville Beach Florida is 75. The 2018 United States Supreme Court decision in South Dakota v. Florida has a 6 sales tax and Jackson County collects an additional 15 so the minimum sales tax rate in Jackson County is 75 not including any city or special district taxes.

For a blank Public Service Tax Return click here and remit with payment if applicable to the following. The Florida sales tax rate is currently. The fee to transfer a receipt is 600.

Bay County FL Sales Tax Rate. Rates include the state and county taxes. Forsyth St Room 212.

For additional information or clarification please email. The latest sales tax rates for all counties in Florida FL state. Tangible Personal Property Tax.

Estimated Combined Tax Rate 700 Estimated County Tax Rate 100 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount 0025. 2 State Sales tax is 600. Sales Tax and Use Tax Rate of Zip Code 32207 is located in Jacksonville City Duval County Florida State.

This is the total of state county and city sales tax rates. Jacksonville s millage rate of 176076 on real property is the lowest of all major cities in Florida and the states 50000 homestead exemption plan adds additional. The total sales tax rate in any given location can be broken down into state county city and special district rates.

You must apply for new Local Business Tax Receipts in person at our downtown office 231 E Forsyth St. For more information call the Departments Taxpayer Assistance at 850-488-6800 Monday through Friday excluding holidays. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

Inquire about your property on the link below or contact the Tax Collector by phone or email. At DDF CPA Group we strive to meet each clients. Duval County Tax Collector.

Suite 130 Jacksonville FL 32202. The total sales tax rate in any given location can be broken down into state county city and special district rates. Duval County Tax Collector Attn.

Fleming Island FL 32003. Did South Dakota v. DDF CPA Group provides a wide range of services to individuals and businesses in a variety of industries.

Has impacted many state nexus laws and sales tax collection requirements. Florida provides a 5000 local discretionary surtax cap for sales and leases of tangible personal property over 5000 if certain criteria are met. St Johns County Tourism Development.

Jacksonville Florida Community Wealth Org

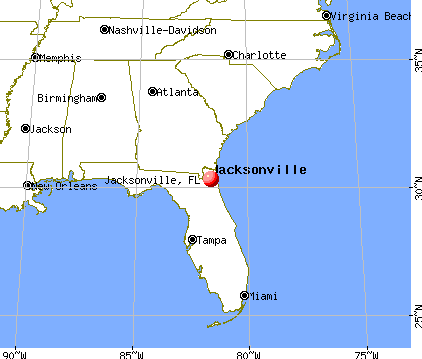

Jacksonville Florida Fl Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Thinking Of Moving To Jacksonville Fl

16176 Hargett Rd Jacksonville Fl 32218 Mls 1028576 Zillow House Styles Zillow Entrance Foyer

Jacksonville Florida Joblink 2021 Job Fair Veteran Owned Businesses News Vobeacon Job Fair Jacksonville Business News

Jacksonville Florida Facts For Kids

Jacksonville Florida 1963 Postcard Howard Johnson S Motor Lodge Restaurant Ebay Jacksonville Florida Duval County Postcard

Duval County Courthouse Closed To The General Public Jax Daily Record Jacksonville Daily Record Jacksonville Florida Duval County Courthouse Florida

Duval Sales Tax Referendum Our Duval Schools Jacksonville Duval County Duval Public School

Springfield Jacksonville Florida Jacksonville Florida Jacksonville Beach Old Florida

Our State Seal State Of Florida Florida Places In Florida

Duval Tax Collector Duvaltaxcollect Twitter

News4jax Youtube Duval County Sales Tax Battle

State Road 202 J Turner Butler Boulevard Aaroads Florida

Jacksonville Florida Fl Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Bank Owned Waterfront Homes In Jacksonville Fl Florida Real Estate Beach Houses For Sale Waterfront Homes

Sunflower Fields Near Orlando Orlando On The Cheap Campos De Girassol Jardim De Girassois Girassois